In our new series we investigate the numbers behind ‘the biggest mis-selling scandal in financial services history’ – PPI.

In this first instalment we look at the staggering amounts that tell the true story of the saga – the provisions set aside by lenders, how much has been claimed back so far and just how much profit was made from mis-selling PPI.

What could £47bn buy you these days?

How about two weeks away on your own private island in the Caribbean, with a personal chef and tour guides as your only company?

Or for a more permanent stay how about the most expensive property in the Hamptons, with 42-acre estate and a quarter-mile private coastline? And to get there the most expensive car in the world, the Bugatti La Voiture Noire?

Well in fact for £47bn, the same amount as the total PPI bill for UK banks, you could buy one of those private islands, own 268 of those Hampton properties and store 3,000 Bugattis in their many garages.

The staggering amounts of money set aside by UK banks and lenders for PPI compensation is hard to put into some kind of tangible context.

When a financial sum reaches the billions it’s often hard for the average person to fathom, but that’s the reality when it comes to the total PPI bill after a decade of banks and lenders misleading their customers amounting to almost £50bn.

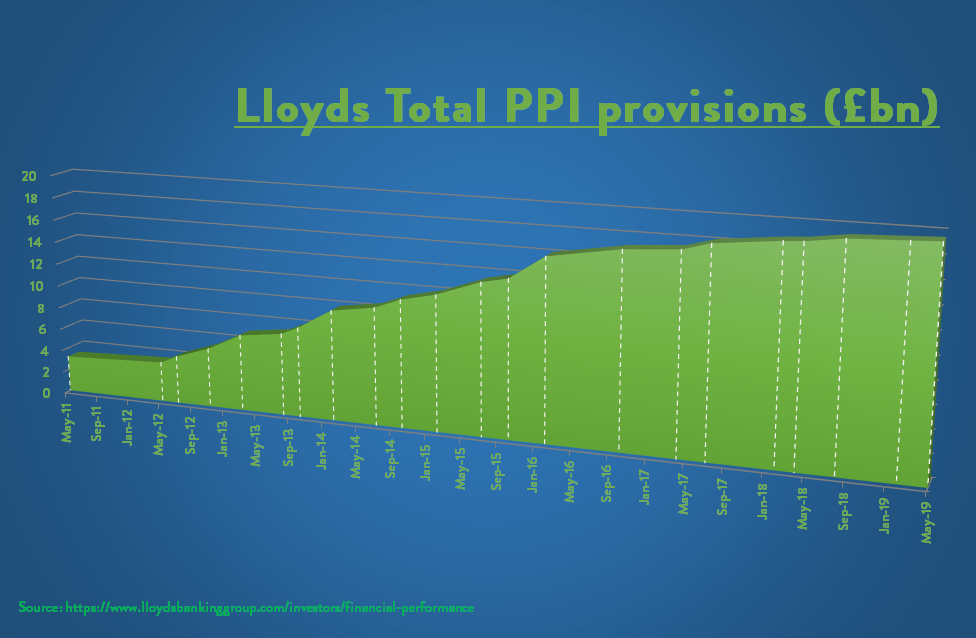

These provisions are revealed in amongst the banks’ financial reports which are published four times a year. Sometimes they can be hard to spot, in amongst all the jargon and numbers, but each major bank has been steadily setting more and more money aside since the scandal began in 2011.

Lloyds Banking Group are the worst offenders in the saga, accounting for more than half the total set aside, and have announced twenty increases to their own PPI provisions despite multiple claims that they had done so for the final time.

In 2018 alone there were also increases to the PPI bills at Barclays, Shop Direct, CYBG, Santander and Nationwide in addition to two rises at Lloyds.

Industry regulator the Financial Conduct Authority (FCA) confirmed the claims deadline of August 29th this year, leaving the banks hoping for an end to burying more of those announcements inside their quarterly results.

So why have lenders needed to set so much aside for PPI?

With so much at stake you could be forgiven for thinking that PPI must have affected most of the adults in the UK.

Accurate numbers on how many people have complained about PPI are difficult to obtain. Official complaint figures come from the FCA but these are not published on a frequent basis, unlike for example monthly compensations amounts.

We know that the volume of PPI complaints being sent to banks and other lenders are close to record levels, 13,000 every week at Lloyds, with a minimum of 16.7m complaints confirmed to date.

This is made up of 13m complaints which were confirmed by the FCA back in 2011 and 3.7m complaints made during the first 10 months of the FCA’s deadline awareness campaign, fronted by an Arnold Schwarzenegger impersonator.

Indeed this figure represents almost a third of the adult population of the UK, demonstrating just how widespread this scandal truly was.

For the millions affected who have successfully complained the amount they receive in compensation can vary. From small sums which simply give them peace of mind that they have got back what is rightfully theirs, right up to life-changing amounts of money, most are glad they checked.

On average our successful clients here at The Fair Trade Practice receive more than £3,300*, but our highest ever single offer was in 2017 for a Barclaycard customer mis-sold PPI with a credit card.

Though it is clearly not an indicator of every consumer’s experience, in that instance the bank paid out more than £100,000** in redress which remains the highest figure we have seen to date.

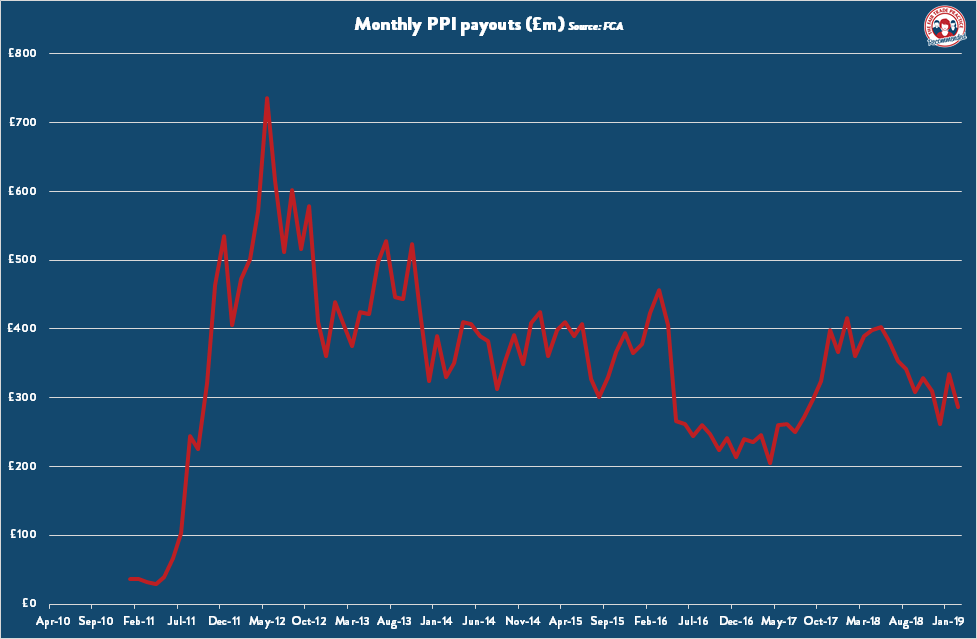

Over the last year a total of £4.1bn in PPI redress has been paid to consumers who were mis-sold, with much more still to come.

You might expect the list of firms who mis-sold PPI to include big name high street banks like Lloyds, Barclays and NatWest.

Whilst that is indeed the case, you might be surprised to learn that our customers have also had successful claims against the AA, Argos, DFS, Sainsbury’s & Tesco in 2019 – we’ve even seen an offer from BMW Finance and another from high street store M&Co*** so far this year.

It’s also surprising who banks and lenders mis-sold PPI to. Over the last two years, our customers in their 40s & 50s have received almost twice as much compensation as all other age groups combined†.

The fact that mis-selling was so widespread and in so many places might explain why 95%* of our successful customers were unsure if they had PPI before they came to us.

Why was PPI mis-sold so widely? What was in it for the people who mis-sold it?

In one word – profits. In fact two words – huge profits.

According to a report by the Competition Commission back in 2008 lenders selling PPI could expect a return of 982%. Yes you read that correctly.

As this story from the time put it: “Banks would struggle to make money from personal loans without PPI. Put another way, they can earn £1,200 from a policy that costs £20 to provide.”

Despite these findings it was years before these levels of profit were truly reined in, when a landmark court case paved the way for consumers to claim compensation on PPI for a second reason.

Susan Plevin was a retired college lecturer who took her mis-sold PPI complaint all the way to the Supreme Court, where it was decided the amount of PPI premiums she had paid which were attributed to commission was unusually high.

Several years later industry regulator the Financial Conduct Authority (FCA) took this ruling, known as Plevin, and used it to apply a new principle to PPI complaints.

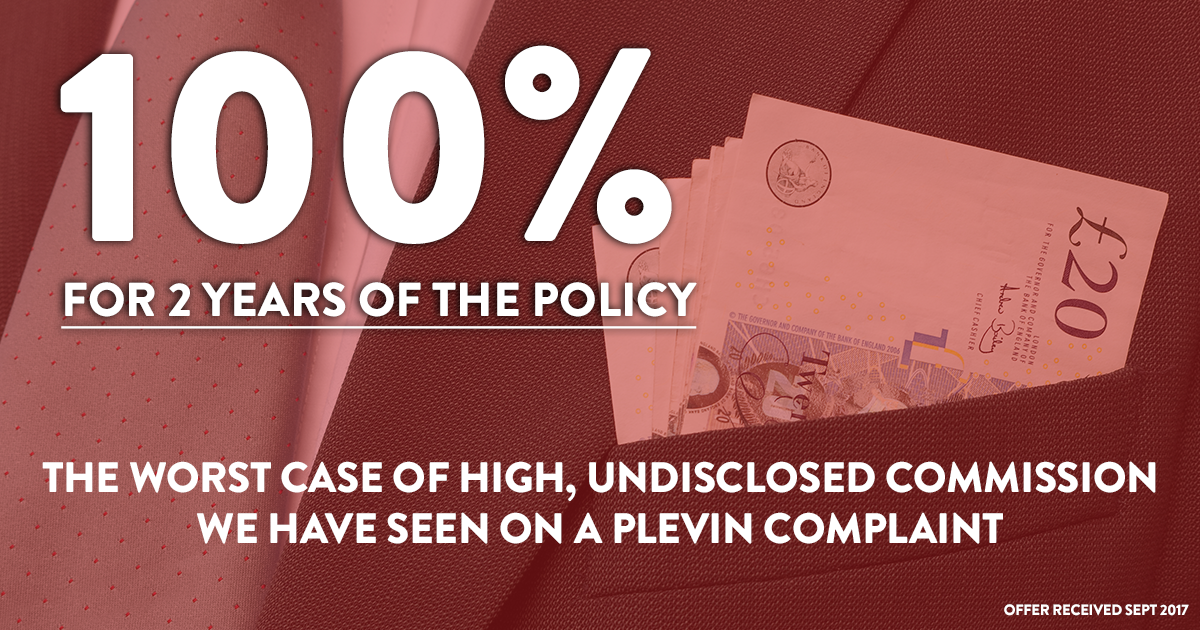

They decided that any lender who sold a PPI policy where commission was over 50%, and the customer was not informed, must now pay compensation. The amount due back is the difference between the rate of commission paid and 50%.

Despite their own research showing the average level of commission on PPI policies was in fact 67%, the regulator declared this approach ‘fair and reasonable’.

That’s despite data from the Competition Commission back in 2008 finding that the typical level of commission on person loan and credit card PPI was as high as 80%.

Even with this ‘tipping point’ set at a debatable level, Plevin cases have since poured in to banks and lenders at huge volumes with some surprising results.

Back in his Spring 2017 update, Quality Director at the Financial Ombudsman Service (FOS) Richard Thompson said more than 145,000 PPI cases were affected by the FCA’s Plevin rules.

That’s in addition to more than a million people who were written to by the banks, advising that despite having previously had a case rejected they could complain again thanks to Plevin.

As recently as March, the FOS revealed that more than 9,400 Plevin complaints were upheld in favour of the consumer between July and December last year alone.

Quite how bad the issue of commission on PPI policies was may never truly be known. That’s because banks only have to assess these levels on a complaint-by-complaint basis.

There are also rumours of banks taking steps to limit the effect of Plevin cases, with non-disclosure agreements and industry pressure.

As a result there have been several large figures touted by commentators and the media as to how much Plevin might really end up costing the banks.

Last April a barrister suggested that the ‘true value’ of claims was ‘significantly higher’ than the FCA thought, and Plevin could cost the banks a further £18bn, whilst a study chaired by Lord Myners, formerly the City Minister, gave a figure of £33bn.

On their dedicated PPI website the FCA says of Plevin complaints: “We think many payments could be in the hundreds of pounds”. However our highest Plevin offer to date here at The Fair Trade Practice was an astonishing £67,789‡.

The most important numbers of all… 29-08-2019

It’s clear then what the advantages were for those who mis-sold PPI, and what the disadvantages were for those they mis-sold it to.

If you’re wondering if that could include you then you’re drastically running out of time to find out for sure.

Millions still haven’t checked their finances for mis-sold PPI yet despite the claims deadline being just months away. How about this for our final big number… £10.5bn of lender provisions are set to go unclaimed based on current complaint levels.

*As at December 2018

**Offer received October 2017

***Data correct as of May 2019

†As at February 2019

‡Offer received March 2018